Do we really know what the customs regulations are for doing this? Let's dispel the false myths.

After spending an entire winter structuring and planning investments on the hospitality strategy in view of the summer, the season is finally coming into full swing and visits by foreign tourists are starting to multiply.

The ideal recipe: weigh a kilogram of events, sprinkle the training team, fill the tasting rooms with a good restyling and, finally, bake the new reception strategy. We are ready!

More and more attentive to the needs of our enthusiasts and ready to pamper every single customer arriving from the most remote corner of the earth. Many, many resources used for incoming wine tourism, but do we really know what the correct tax and customs procedure is to legally ship to our visitors visiting from abroad?

Let’s then shift through the most used methodologies one by one.

Transport of wine by private customer’s own transport in the EU

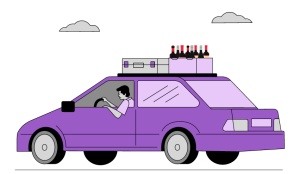

Independent transport requires first of all the use of the customer’s own vehicle and that the purpose of the transport is for personal use only.

In this sole case, there is the possibility of purchasing and transporting the alcoholic product by own means to any Member State, subject to certain limitations on quantities. To the consumer it is applied the excise duty of the Member State in which the products are purchased is applied, in the Italian case the excise duty that the customer should pay is equal to 0.

Article 11 of Legislative Decree no. 504/1995, in line with article 32 of Directive 2018/118/EC, states:

“1. For products subject to excise duty and released for consumption in another Member State, purchased by private individuals for their own use and transported by them, the excise duty is due in the Member State in which the products are purchased.

2. Products purchased and transported by private individuals within the following quantities can be considered purchased for own use:

a) spirit drinks, 10 litres;

b) intermediate alcoholic products, 20 litres;

c) wine, 90 litres, of which 60 litres, maximum, of sparkling wine;

d) beer, 110 litres. (…) ”.

In order for the seller to correctly pay VAT, in the case of the sale of alcohol in Italian territory, the Italian company will have to apply Italian VAT.

Any other transport system, including self-shipping or payment by the customer for the shipment only, are always subject to the payment of excise duty in the country of destination and involve a customs opening and closing process, in which it always remains However, the seller is responsible.

Let’s now look at it specifically.

Self-shipping within the EU. Is it still possible?

Let us remember that self-shipping must not be confused with independent transport by private consumers with their own means. By self-shipping we mean the procedure whereby the customer, once purchased the wine locally, brings the wine purchased from the courier with his own vehicle and has the wine shipped directly abroad to his home, handing the package over to the relevant carrier.

In the event that the seller is involved in any part of the phases mentioned above, he will be traceable and traceable, in the event of checks by the authorities, to the sanctioning regime, in the event that the following have not been carried out: all the opening and customs clearance, in the event that the excise duty has not been paid in the country of destination and in the event that the VAT has not been paid at destination according to the threshold established by the OSS Regime in EU territory. Therefore, giving more concrete examples, if the seller makes the customer pay for the shipment on site, or has the shipment inserted directly on the site of the reference carrier and the collection of the goods is foreseen in any warehouse attributable to the company or in which it has made the product available for shipping, also in this case we remind you that the company is traceable and liable to sanctions if the correct tax and customs procedure

Article 36 of Directive 2018/118/EC, in fact, explicitly refers to indirect shipping by the seller, stating:

“1. Excise goods already released for consumption in a Member State which are purchased by a person, other than an authorized warehouse keeper or a registered consignee, established in another Member State who does not carry out an independent economic activity and are dispatched or transported to another Member State directly or indirectly by the seller or on his behalf are subject to excise duty in the Member State of destination.

For the purposes of this Article, ‘Member State of destination’ means the Member State of arrival of the shipment or transport.

2. In the case referred to in paragraph 1, excise duty shall become payable in the Member State of destination upon delivery of the excise goods. (…)

3. The person liable for the excise duty payable in the Member State of destination is the seller. (…)”

It is therefore clear from the directive that the only method contemplated, as a legal method, is that in which the end customer from another Member State brings with him the packages of alcohol to be shipped and purchased from the seller, with his own vehicle and directly to the courier chosen by him, paying the corresponding shipping.

Is it possible to send wine abroad to private individuals in the EU without paying excise duties and by issuing a receipt with Italian VAT?

It Depends. The only permitted case is the sale of the alcoholic product in Italian territory with independent transport by the private customer with his own vehicle within the EU borders and only for personal use.

In all other cases it is NOT possible not to pay the excise duty due. In fact, all goods released for consumption in an EU Member State subject to excise duty must in turn be subject to the payment of excise duties.

Even if the excise duty to be paid is equal to 0, the legislation establishes that the seller is required to manage the customs paperwork and all the documentation for the transport of the goods subject to excise duty.

The winery or the retailer, selling abroad to the final consumer, are therefore solely responsible.

As regards the issuing of the receipt with Italian VAT, only in the case in which the customer takes the wine away independently with his own means, then yes, it is allowed to issue a receipt with Italian VAT, as, for all intents and purposes, it is of a sale in Italian territory.

However, as regards wine that must be shipped to EU territory, the new OSS legislation which came into force in 2021 establishes rules.

Distance sales mean any shipment of goods carried out via an electronic interface or which involves indirect sales, therefore payment for the goods and also their shipment to an EU country. In this case, issuing a receipt with Italian VAT is not always correct. The OSS legislation, in fact, provides that this type of sales be carried out with Italian VAT only and exclusively for a maximum amount of 10,000 euros per calendar year throughout the EU territory. Once this amount is exceeded, all sales must be made with the payment of the VAT of the country of destination also in subsequent years.