The D2C solution for point of sale:

Nightmare with customs and taxes?

Are sales involving shipping your alcoholic beverages to private customers abroad keeping you up at night?

Don’t let the tourist have to perform heroic feats to bring your alcoholic beverages home.

Whether it’s following a tasting at the point of sale or responding to requests you receive via email and phone, there are strict regulations that burden the seller, whether selling within the European Union or outside the EU.

For this reason, it is essential to rely on a partner who can transparently comply with all the fiscal and customs regulations.

Direct from Italy has developed the solution to make your D2C sales from your point of sale practical and compliant: Direct from Producer.

Nightmare with customs and taxes?

Do sales involving shipping your spirits to individuals abroad not make you sleep soundly?

Don’t let the tourist have to perform heroic feats to bring your alcoholic beverages home.

Whether it is as a result of point-of-sale tasting, or in response to inquiries you receive via e-mail and telephone, there are strict regulations that loom over the seller whether they sell in the EU or Extra-EU.

For this reason, it is essential to rely on a partner who can transparently comply with all the fiscal and customs regulations.

Direct from Italy has come up with the solution to make your D2C sales from your point of sale, convenient and compliant: Direct from Producer

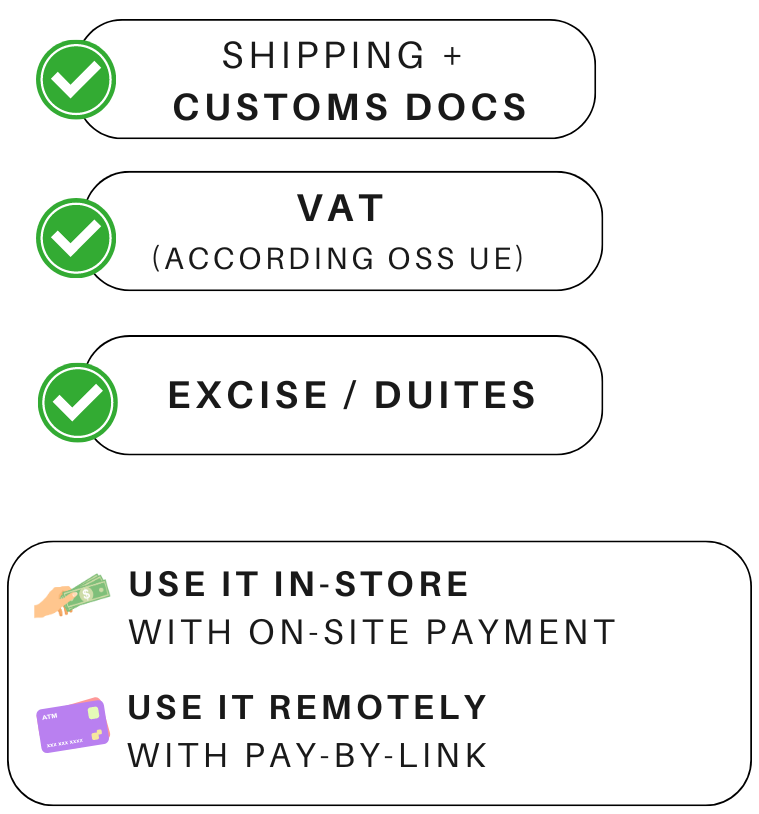

Usage options – You’re spoiled for choice!

You choose where and how to sell

Andorra, Antigua and Barbuda, Argentina, Australia, Austria, Bahamas, Belgium, Bulgaria, Canada, China, Cyprus, Colombia, Korea, Croatia, Denmark, United Arab Emirates, Finland, France, Germany, Japan, Greece, Hong Kong, India, Canary Islands, Israel, Italy, Liechtenstein, Norway, New Zealand, Netherlands, Portugal, United Kingdom, Czech Republic, Russia, Singapore, Slovenia, Spain, USA, South Africa, Sweden, Switzerland, Taiwan, Ukraine.

Andorra, Antigua, Argentina, Australia, Austria, Bahamas, Belgium, Korea, Denmark, United Arab Emirates, Finland, France, Germany, Japan, Hong Kong, India, Canary Islands, Italy, Norway, New Zealand, Netherlands, United Kingdom, Czech Republic, Russia, Slovenia, Spain, Singapore, South Africa, Sweden, Switzerland.

Andorra, Antigua, Argentina, Australia, Austria, Bahamas, Belgium, Korea, Denmark, United Arab Emirates, Finland, France, Germany, Japan, Hong Kong, India, Canary Islands, Italy, Norway, New Zealand, Netherlands, United Kingdom, Czech Republic, Russia, Slovenia, Spain, Singapore, South Africa, Sweden, Switzerland.

Andorra, Antigua, Argentina, Australia, Austria, Bahamas, Belgium, Korea, Denmark, United Arab Emirates, Finland, France, Germany, Japan, Hong Kong, India, Canary Islands, Italy, Norway, New Zealand, Netherlands, United Kingdom, Czech Republic, Russia, Slovenia, Spain, Singapore, South Africa, Sweden, Switzerland.

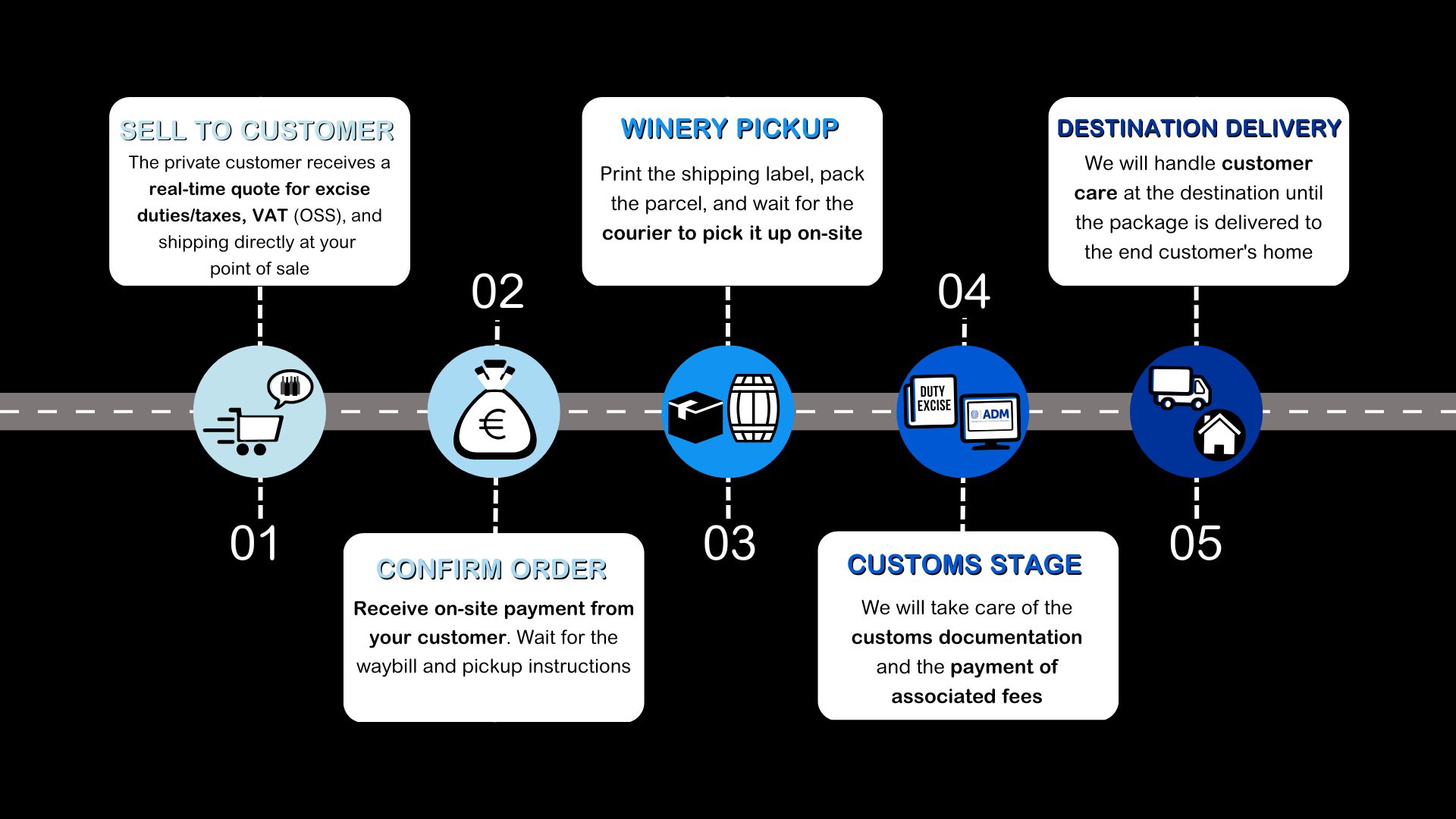

How it works?

Our point-of-sale systems ti allow to be in control over customs charges and document management to sell directly to your private customers abroad.

You will be able to sell abroad while complying with customs and tax regulations, from your point of sale or responding to requests received via e-mail, telephone, without using intermediaries.

Don’t give away your margins to others, become INDEPENDENT!

The system provides real-time quotes:

How it works?

Our point-of-sale systems ti allow to be in control over customs charges and document management to sell directly to your private customers abroad.

You will be able to sell abroad while complying with customs and tax regulations, from your point of sale or responding to requests received via e-mail, telephone, without using intermediaries.

Don’t give away your margins to others, become INDEPENDENT!

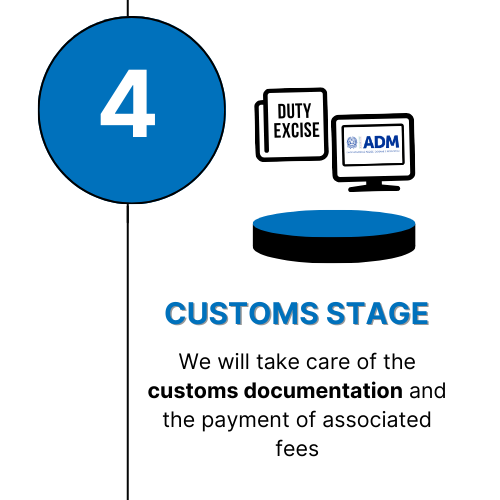

How does the process work?

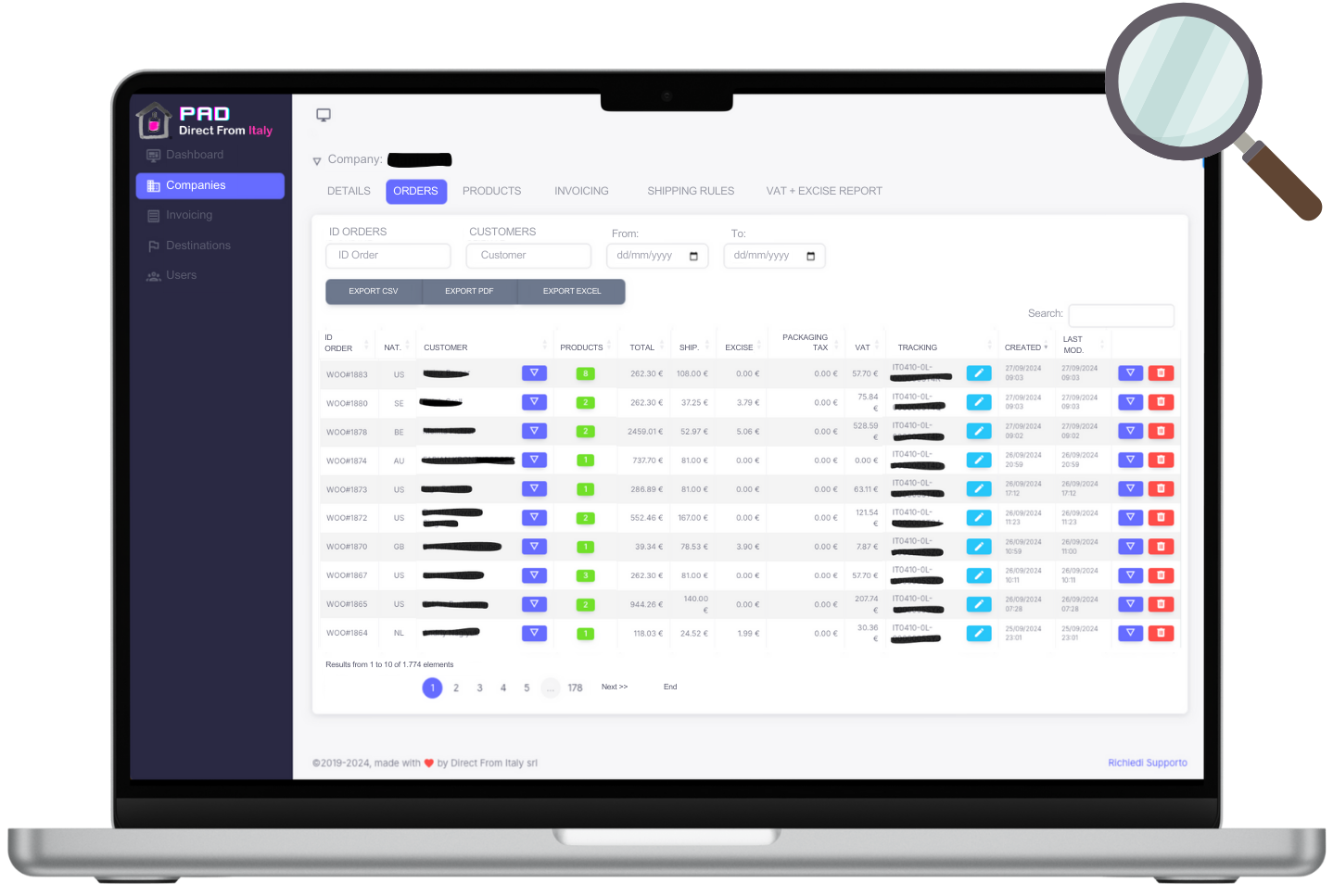

Keep everything under control from the management dashboard: PAD

Manage the customs and logistics specifications of your products

Excel export for invoicing and cost components

Access reports on excise duties, VAT (OSS), and packaging tax

Enter orders from the point of sale or on demand

Manage your shipping rules for each country

Choose the Direct from Producer option that suits you best:

For wineries

For distilleries

For breweries

Set up Direct from Winery / Distillery / Brewery: starting from 349 Euros

Choose the D2C Customs License for customs management

BASE

For MICRO ENTERPRISES: The essentials to create your direct sales network to private customers abroad, with complete legality and independence.- 15% management fee, applied only to the taxable amount of the product sold, which can also be charged to the final customer

- Excise/customs management for a single type of alcohol of your choice: wine, spirits, or beer

- Automation for E-commerce (major CMS platforms) or Direct from Producer

- Offline order entry from the point of sale or remotely via a dedicated area on the PAD dashboard

- Help Center Support

STANDARD

For SMALL BUSINESSES: Everything you need for the autonomous and automated management of flows to private customers wherever you want, worldwide.- Everything included in the BASE plan plus:

- 8% management fee, applied only to the taxable amount of the product sold, which can also be charged to the final customer

- Support package via ticket (extension to full call-back support package: €500/year)

- Custom management areas: shipping discounts, creation of mixed product bundles

MAGNUM

For MEDIUM-SIZED BUSINESSES: A step up in quality for the complete online and on-site management of sales to private customers abroad—no more limits.- Everything included in the STANDARD plan plus:

- 5% management fee, applied only to the taxable amount of the product sold, which can also be charged to the final customer

- Excise/customs management for ALL types of alcohol: wine, spirits, intermediate alcohol, and beer

- Custom management areas: shipping discounts, excise and VAT (OSS) reports, and insured shipments

- Multi-site management for a single VAT number

JEROBOAM

For LARGE ENTERPRISES and GROUPS: Ideal for large multi-store businesses with high scalability needs and custom integrations.- Everything included in the MAGNUM plan plus:

- Management fee configurable based on sales volume, which can also be charged to the final customer

- Multi-site automation across multiple e-commerce platforms and/or Direct from Producer, also for companies within the same group with different VAT numbers

- Seamless integration with complex management systems and customized corporate e-commerce platforms

- Included custom multi-point of sale system: Direct from Producer

- FULL support package included