The solution for customs compliance of your alcoholic beverages:

Nightmare with customs and taxes?

Do sales involving shipping your alcoholic beverages to private customers abroad keep you from sleeping peacefully?

Whether it’s from your e-commerce or following a tasting at the point of sale, there are strict regulations that burden the seller, whether selling within the European Union or outside the EU.

For this reason, it is essential to rely on a partner who can transparently comply with all the fiscal and customs regulations.

Direct from Italy has developed the solution to make your sales to private customers practical and compliant: D2C Customs.

Nightmare with customs and taxes?

Do sales involving shipping your alcoholic beverages to private customers abroad keep you from sleeping peacefully?

Whether it’s from your e-commerce or following a tasting at the point of sale, there are strict regulations that burden the seller, whether selling within the European Union or outside the EU.

For this reason, it is essential to rely on a partner who can transparently comply with all the fiscal and customs regulations.

Direct from Italy has developed the solution to make your sales to private customers practical and compliant: D2C Customs.

Usage variations, you’re spoiled for choice

Choose where and how to sell

Andorra, Antigua and Barbuda, Argentina, Australia, Austria, Bahamas, Belgium, Bulgaria, Canada, China, Cyprus, Colombia, Korea, Croatia, Denmark, United Arab Emirates, Finland, France, Germany, Japan, Greece, Hong Kong, India, Canary Islands, Israel, Italy, Liechtenstein, Luxembourg, Norway, New Zealand, Netherlands, Portugal, United Kingdom, Czech Republic, Russia, Singapore, Slovenia, Spain, USA, South Africa, Sweden, Switzerland, Taiwan, Ukraine.

Andorra, Antigua, Argentina, Australia, Austria, Bahamas, Belgium, Korea, Denmark, United Arab Emirates, Finland, France, Germany, Japan, Hong Kong, India, Canary Islands, Italy, Luxembourg, Norway, New Zealand, Netherlands, United Kingdom, Czech Republic, Russia, Slovenia, Spain, Singapore, South Africa, Sweden, Switzerland.

Andorra, Antigua, Argentina, Australia, Austria, Bahamas, Belgium, Korea, Denmark, United Arab Emirates, Finland, France, Germany, Japan, Hong Kong, India, Canary Islands, Italy, Luxembourg, Norway, New Zealand, Netherlands, United Kingdom, Czech Republic, Russia, Slovenia, Spain, Singapore, South Africa, Sweden, Switzerland.

Andorra, Antigua, Argentina, Australia, Austria, Bahamas, Belgium, Korea, Denmark, United Arab Emirates, Finland, France, Germany, Japan, Hong Kong, India, Canary Islands, Italy, Luxembourg, Norway, New Zealand, Netherlands, United Kingdom, Czech Republic, Russia, Slovenia, Spain, Singapore, South Africa, Sweden, Switzerland.

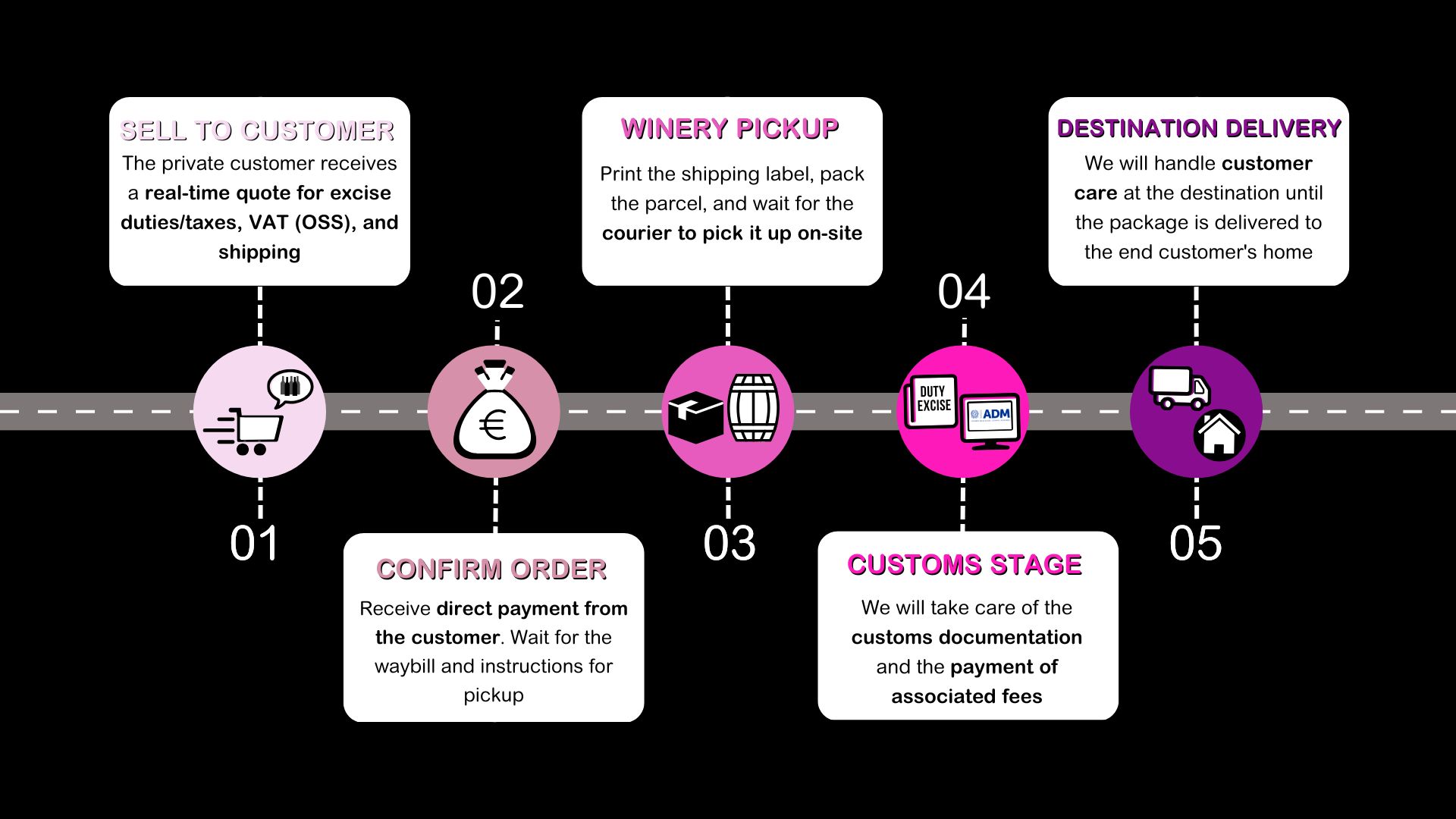

How it works?

D2C Customs allows you to be in control over customs charges and document management to sell directly to your private customers abroad.

You will be able to sell abroad while complying with customs and tax regulations, either through YOUR E-commerce and from your point of sale, without using intermediaries.

Don’t give away your margins to others, become INDEPENDENT!

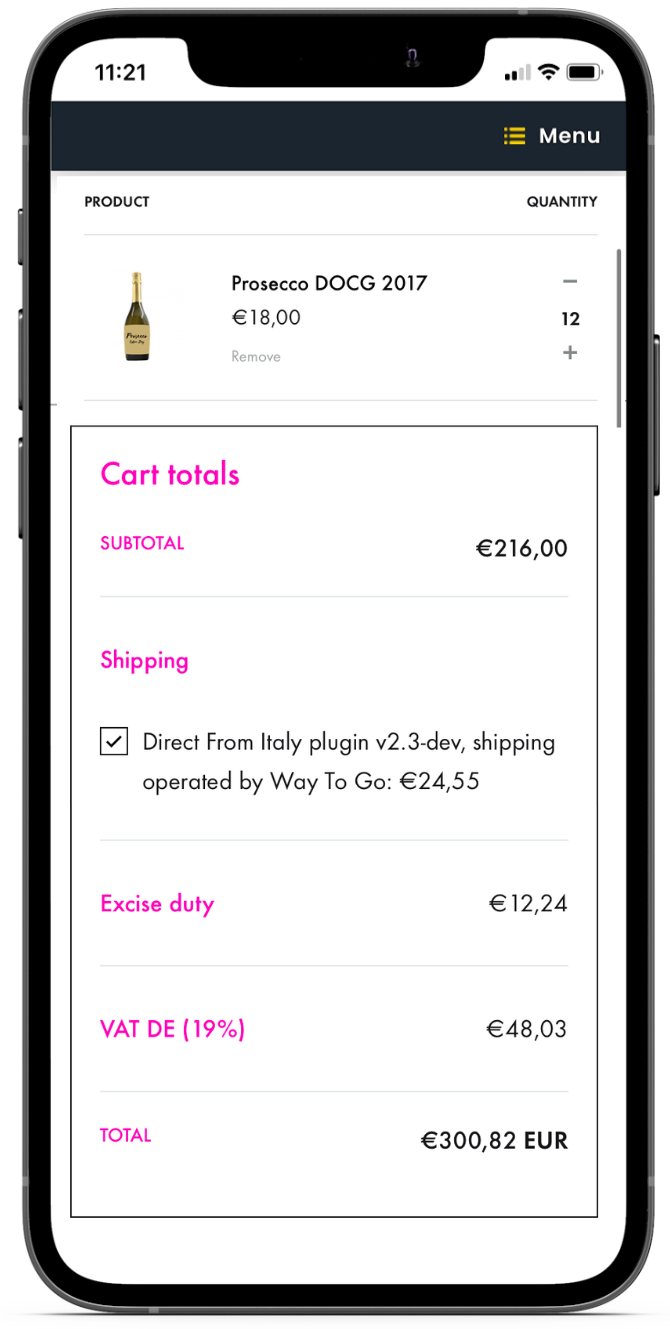

The system provides real-time quotes:

How it works?

Plug-in DFI Excise allows you to be in control over customs charges and document management to sell directly to your private customers abroad.

You will be able to sell abroad while complying with customs and tax regulations, either through YOUR E-commerce and from your point of sale, without using intermediaries.

Don’t give away your margins to others, become INDEPENDENT!

How does the process work?

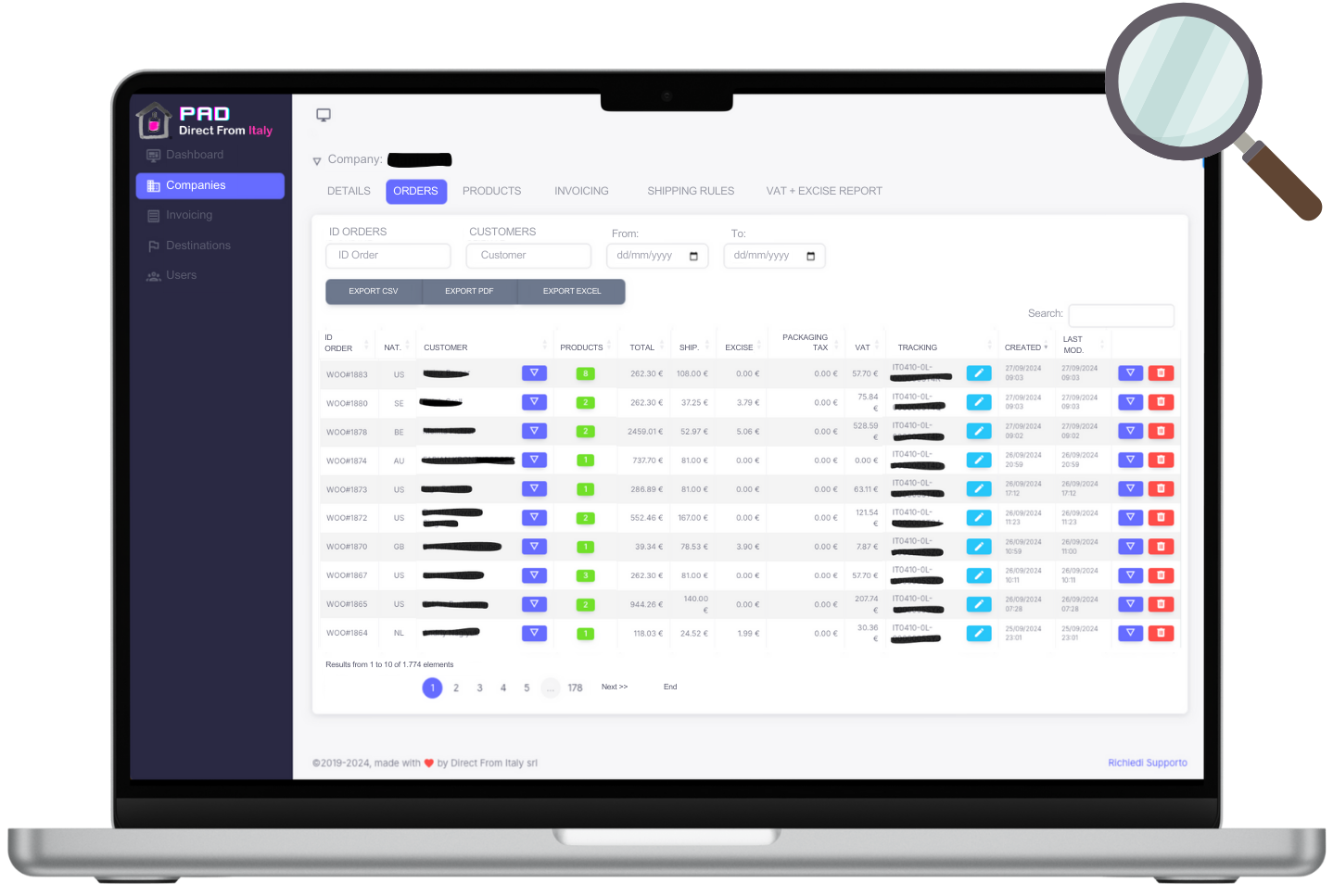

Keep everything under control from the management dashboard: PAD

Manage the customs and logistics specifications of your products

Excel export for invoicing and cost components

Access reports on excise duties, VAT (OSS), and packaging tax

Enter orders from the point of sale or on demand

Manage your shipping rules for each country

What are the benefits of Direct from Italy?

Complete Protection for Your Business

On-Site Direct Pickup and Direct Payments

Time Savings – Your Time is Money!

Autonomous Management Online and In-Store

Complete Traceability of Operations

Multiply Your Business Opportunities Worldwide!

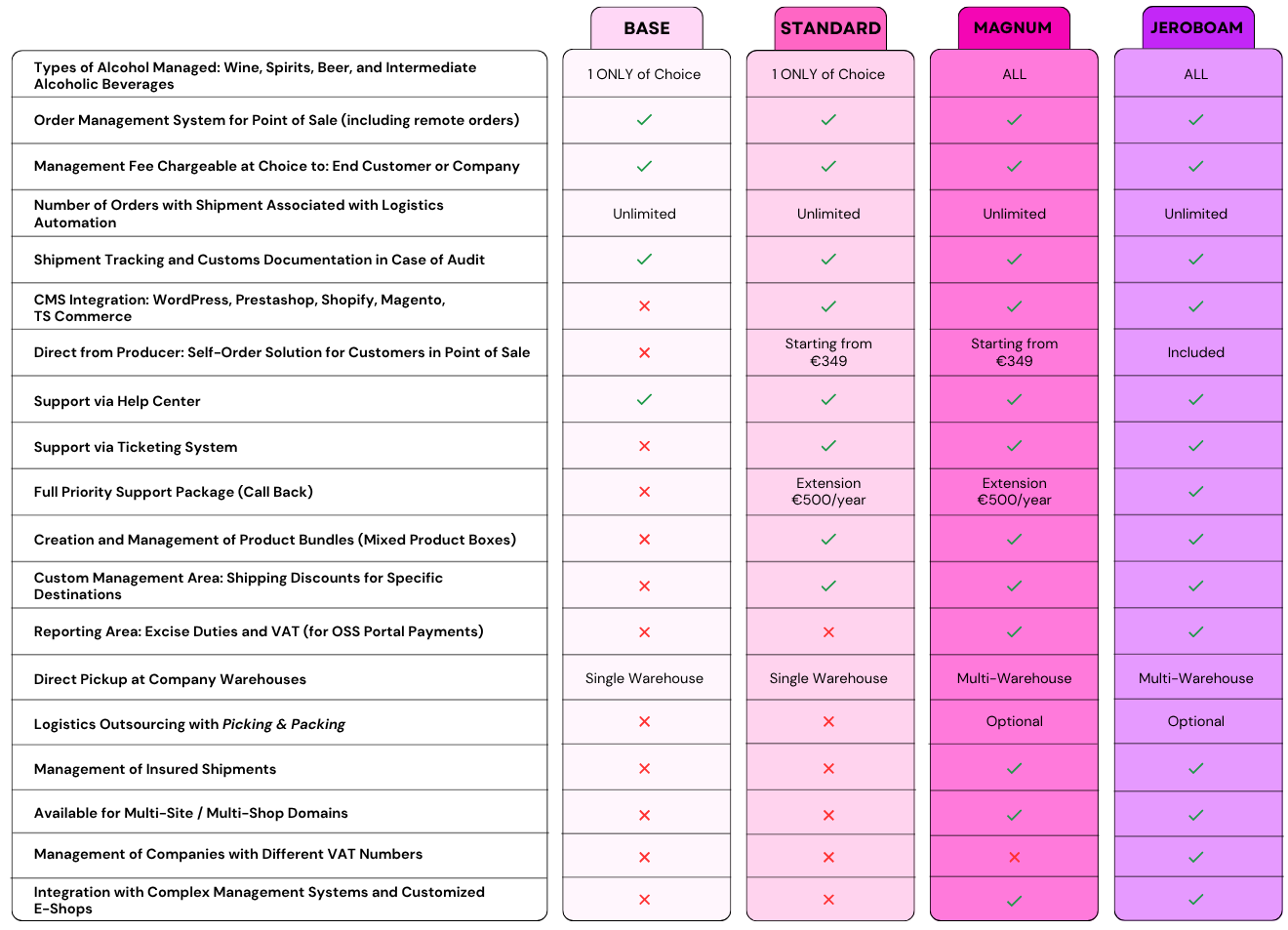

Choose the D2C Customs license that best suits you:

BASE

For MICRO ENTERPRISES: The essentials to create your direct sales network to private customers abroad, with complete legality and independence.- 15% management fee, applied only to the taxable amount of the product sold, which can also be charged to the final customer

- Excise/customs management for a single type of alcohol of your choice: wine, spirits, or beer

- Offline order entry from the point of sale or remotely via a dedicated area on the PAD dashboard

- Help Center Support

STANDARD

For SMALL BUSINESSES: Everything you need for the autonomous and automated management of flows to private customers wherever you want, worldwide.- Everything included in the BASE plan plus:

- Automation for E-commerce (major CMS platforms) or Direct from Producer

- 8% management fee, applied only to the taxable amount of the product sold, which can also be charged to the final customer

- Support package via ticket (extension to full call-back support package: €500/year)

- Custom management areas: shipping discounts, creation of mixed product bundles

MAGNUM

For MEDIUM-SIZED BUSINESSES: A step up in quality for the complete online and on-site management of sales to private customers abroad—no more limits.- Everything included in the STANDARD plan plus:

- 5% management fee, applied only to the taxable amount of the product sold, which can also be charged to the final customer

- Excise/customs management for ALL types of alcohol: wine, spirits, intermediate alcohol, and beer

- Custom management areas: shipping discounts, excise and VAT (OSS) reports, and insured shipments

- Multi-site management for a single VAT number

JEROBOAM

For LARGE ENTERPRISES and GROUPS: Ideal for large multi-store businesses with high scalability needs and custom integrations.- Everything included in the MAGNUM plan plus:

- Management fee configurable based on sales volume, which can also be charged to the final customer

- Multi-site automation across multiple e-commerce platforms and/or Direct from Producer, also for companies within the same group with different VAT numbers

- Seamless integration with complex management systems and customized corporate e-commerce platforms

- Included custom multi-point of sale system: Direct from Producer

- FULL support package included

Don't have or don't want an e-commerce?

Use our point-of-sale solution:

Direct from Producer

Direct from Producer is a cloud solution for exclusive internal use, designed to efficiently manage orders from physical points of sale, as well as requests via email or phone. The system can be used by both reception staff and directly by the end customer in self-order mode, allowing them to place orders independently.

With this setup, pricing dynamics linked to importers are eliminated, as the entire process is managed exclusively within the company. Additionally, the process is instantaneous: orders are recorded in real-time, with immediate quotation of shipping costs and customs duties, while payments are received directly on-site.

Use our point-of-sale solution: Direct from Producer

Direct from Producer is a cloud solution for exclusive internal use, designed to efficiently manage orders from physical points of sale, as well as requests via email or phone. The system can be used by both reception staff and directly by the end customer in self-order mode, allowing them to place orders independently.

With this setup, pricing dynamics linked to importers are eliminated, as the entire process is managed exclusively within the company. Additionally, the process is instantaneous: orders are recorded in real-time, with immediate quotation of shipping costs and customs duties, while payments are received directly on-site.

Compatible CMS

Via WEBHOOK or API

Frequently Asked Questions - FAQ

Of course! The choice is entirely yours. Among the active countries, you can decide where to use D2C Customs as you prefer.

The management fee applies only to the taxable amount of the product sold and managed through D2C Customs. Therefore, it only applies to the countries you have chosen to enable with Direct from Italy. Remember an essential feature: you decide whether the management fee is absorbed by the company or passed on to the end customer as part of the shipping cost.

All Direct from Italy plans always include our PAD order management system, a simple, lightning-fast, and intuitive tool that provides instant customs duty quotes and allows orders to be finalized immediately — maximizing impulse purchases from private customers with full customs compliance and automated logistics management. With PAD, you can keep all your orders under control, whether they come from remote sales or in-store purchases, thanks to a centralized management dashboard.

Starting from the Standard License, you can also integrate D2C Customs directly into your own e-commerce site or Wine Club: the system is invisible to your customers and activates only to automatically calculate customs duties at checkout.

Alternatively, you can enable the Direct from Producer module, which lets your customers place orders independently in-store through a dedicated self-order system. Discover it now: Direct from Producer

D2C Customs enables you to be completely independent in managing your direct-to-consumer sales to private customers abroad.

The system allows you to easily and automatically manage: customs paperwork, calculations of tax and customs duties, and shipping costs for your alcoholic beverages. This way, you can open a direct sales channel to your customers without needing importers or tax warehouses at the destination.

Excise duties, tariffs, and VAT at destination (according to OSS regulations for the EU) will no longer be an obstacle to your sales, as they will be quoted directly in your e-commerce cart and clearly presented to your end customer. The system will connect you directly to customs and integrated logistics.

You won’t need to establish customs relationships with each individual country you want to target, nor handle customs clearance because we will take care of it for you.

This way, in addition to saving a lot of time and resources, you will have made the entire process practical and automatic.

From your online e-commerce site (starting from the Standard License), on your international Amazon storefronts (for EU Sellers only), or even by turning your e-commerce into a system to receive orders directly at your winery with on-site payment!

Potentially, you can use it on any device with an internet connection, and it can also be made available directly to your customers — for example, by providing a tablet in-store.

The payment comes from the customer directly to YOU, without any type of intermediary, already including all customs, tax duties, and shipping costs.

You are free to manage the sale and payment using your preferred methods.

If the customer orders online, you will receive the payment according to the payment methods you have already set up. If you also use the system at the point of sale, you can receive payments directly in cash or via POS from your customer.

NOTHING! Everything remains the same; the D2C Customs Plug-in integrates completely transparently and will only activate at the checkout phase to show your customer the quote for excise duties, tariffs, VAT (at destination according to OSS regulations), and shipping costs.

You can choose how to display costs and customs duties; whether aggregated in a single item or separately.

Wine, beer, spirits, intermediate products, food, juices, oil, gadgets, merchandising, special boxes, bundles – sell what you want, where you want, with no quantity limits.

Need to manage all types of alcoholic beverages simultaneously? Request the MAGNUM or JEROBOAM version.

You won’t have to manage any customs bureaucracy or contact any courier.

All you need to do is properly pack the box with certified packaging and apply the shipping label that you will automatically receive via email from our integrated logistics.

All documentation will indeed be managed by our system along with logistics.

By default, we organize direct pickup at the winery, with no additional cost.

Alternatively, you have the option to request outsourcing and picking packing through the logistics connected to our system with the PRO, PLUS, and ENTERPRISE versions.

For sales abroad, it is used exclusively for sales to private customers D2C (direct-to-consumer).

If you sell in Italy, you can target both businesses and private customers.

Yes, you can sell special bottles, wooden boxes, cartons, cans, and gift packages. Choose the license that best suits your needs.

You can request a personalized consultation by filling out the request form at the bottom of the page.

We are compatible with standard e-commerce platforms such as WordPress (WooCommerce), Shopify, Magento, TS Commerce, and Prestashop (available starting from the STANDARD License).

Alternatively, if your e-commerce is custom-built, we will provide you with API access for integration (available exclusively with the MAGNUM License).

The courier is automatically assigned by the system based on the destination selected by your customer.

Instructions for pickup and shipping label will be automatically sent to you via email after you place your order.

Of course! You can manage all your orders directly from our PAD control panel, a cloud-based system designed for the fast and efficient entry of orders received both in-store and remotely.

If you’re looking for an even more automated solution, we also offer a turnkey system to facilitate self-ordering for customers visiting your tasting room. This will help enhance the wine tourism experience and expand your business opportunities.

Additionally, with our management system, you can easily register orders received via email, centralizing all sales into a single tool.

Discover now: Direct from Producer